Chip warfare: US-China tensions being ramped up in battle to be No.1

The world’s largest maker of artificial intelligence chips has found itself in the front line of a fresh push by the US to frustrate China’s ambition of overtaking the US to become the world’s technology superpower.

Last week, Nvidia disclosed (in a Securities and Exchange Commission filing) that the US government had imposed export restrictions on two of its most advanced chips, barring the company from exporting them to China or Hong Kong. Advanced Micro Devices (AMD) also revealed it had received a similar order.

While AMD said the impact of the ban was unlikely to be material, for Nvidia it seems it will be highly material, affecting about $US400 million ($590 million) of sales in the current quarter. It said it had been told the new licensing requirement was to reduce the risk the products might be used by China’s military.

The restrictions on the sales of advanced semiconductors – it appears Nvidia and others in the US will be able to continue to sell less sophisticated chips to China – follows the recent passage through Congress of the CHIPS Act, which provides more than $US52 billion of funding to boost domestic manufacturing of semiconductors in the US. Taiwanese and Korean chipmakers are now constructing manufacturing facilities in the US.

The CHIPS Act was part of the larger $US280 billion CHIPS and Science Act, the largest five-year federal government funding for research and development in US history.

The CHIPS and Science package was motivated by the sense that the US was losing its technology leadership over China, which has made no secret of its ambition of overtaking the US in artificial intelligence, 5G, aerospace, electric vehicles and biotech. Semiconductors are critical to most advanced technologies.

Indeed, it was China’s hubris in 2015, in making those ambitions overt in its “Made in China 2025″ national strategic plan, that alarmed the Trump administration and prompted it to ban China’s Huawei from selling its equipment in the US and the revoking of export licences from US component suppliers to Huawei, including chipmakers.

That was one of the early shots in what developed into a fully fledged trade war with China. Trump’s tariffs and other trade restrictions have remained in place under the Biden administration.

China has been fiercely critical of the Biden administration’s program to rebuild a domestic chip manufacturing sector – the US once had 40 per cent of the market but now only has about a 12 per cent market share – saying the program violates the World Trade Organisation’s fair trade principles and creates an unfair playing field.

That’s despite China having spent more than $US100 billion of a planned $US150 billion under a state-directed program to fast-track development of its own semiconductor sector, a program that presumably isn’t quite going to plan given recent corruption investigations of many of the sector’s leaders.

China is the world’s biggest market for the chips but manufactures mainly the less advanced chips it needs for its consumer goods manufacturers. It relies on imports from Taiwan, South Korea and the US for the more advanced chips.

Those new generation chips are fundamental for the artificial intelligence that will be increasingly critical to 21st century technologies, including military technologies.

The US effort to slow the rate of China’s technological progress goes beyond the investment in domestic manufacturing and R&D and bans on exports by US manufacturers.

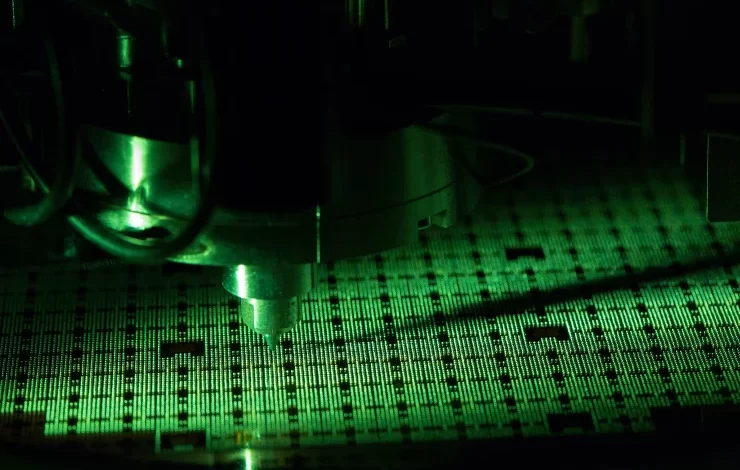

In terms of the machinery for manufacturing the leading-edge chips, Dutch-based ASML is the only supplier of the massive $US150 million machines that can produce the most advanced semiconductors in volume. Under pressure from the US, while ASML sells some of its older systems to China, it hasn’t exported its latest generation machines there since 2019.

The CHIPS Act specifically prohibits companies that receive US funding from increasing their production of chips in China, which will affect Taiwan’s Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea’s Samsung, both of which have US plants under construction and both of which are major suppliers to China.

It’s not that funding that is the most powerful coercive tool in the US armoury. Taiwan and South Korea rely on – and almost completely dependent on – America’s chip designers and equipment makers to produce the advanced chips that the US is focused on.

China might be their biggest market and they all have manufacturing facilities within China but the US dominance of the technology means they would have nothing to sell if they ran foul of the US, whereas China has no realistic alternative at present but to buy from them.

The mutual dependence of the US, Taiwan, South Korea and Japan at the core of the production of advanced chips has led to the formation of a US-led alliance, the so-called “Chip 4”, as a forum for discussing sectoral issues.

The US ambition is obvious. Apart from resolving some of the industry bottlenecks exposed by the pandemic – there are still shortages of semiconductors that affect everything from automobiles production to consumer electronics – the US will want to use Chip 4 to restrict or deny China access to the most advanced chips.

China has been making progress in development of its own capabilities but is still years behind where the bleeding edge of the Chip 4 group’s technologies have reached. The US is trying to maintain and extend that capability gap and the impact it will have on limiting China’s broader technology and military ambitions.

The CHIPs Act isn’t going to turn the US into a powerhouse of chipmaking – it would take trillions of dollars of subsidies and decades to do that – but is a step towards reducing its reliance on Taiwan-based manufacturing, where the threat from China has escalated.

It’s another a brick in the wall it is trying to build, it hopes in conjunction with its Chip 4 allies, around China’s access to the most strategic element of 21st Century technologies and another intense friction point in its increasingly fractious relationship with China.