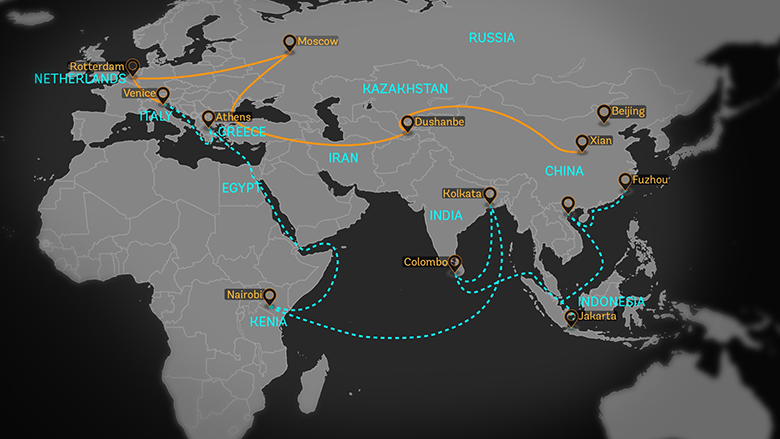

China’s overseas bailouts on Belt and Road totals $240B over two decades

Bank of China extends $170B to some Belt and Road countries in financial or macroeconomic distress, new study unveils

China provided $240 billion in rescue lending to 22 developing countries as part of the Belt and Road Initiative in 2000-2021, according to a new study.

“The scale of China’s global bailout lending program is also growing fast. More than $185 billion was extended in the past five years alone (2016-2021),” read the report by AidData, a research lab at the College of William and Mary in Virginia.

China has extended $170 billion through swap line network, a vital tool of the country’s overseas crisis management, to countries in financial or macroeconomic distress.

“This amount involves a large number of rollovers, as short-term People’s Bank of China swap loans are often extended again and again, resulting in a de facto maturity of more than three years, on average,” it added.

The rest of the amount, $70 billion, was provided through types of rescue lending such as bridge loans or balance of payments support by Chinese state-owned banks and enterprises, like the China Development Bank.

The top three debtors were Argentina, Pakistan, and Egypt, the paper showed.