Report: Naval radar market to surpass US$20 Billion

The global naval radar market size has reached US$ 12.5 billion in 2023 and is forecast to end up at US$20 billion by 2033. Over the next 10 years, Fact.MR’s research projects global demand for naval radars to rise at 4.8 percent CAGR.

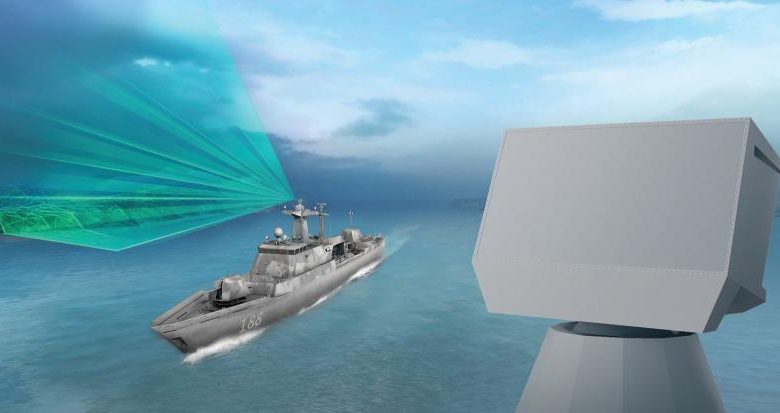

Marine borders have gained prominent strategic importance in military and defence operations around the world, which has resulted in rising spending on naval fleets. Increasing global trade through shipping is also anticipated to uplift the demand for naval radar systems over the coming years.

Rising disposable income and an increasing number of high net-worth individuals around the world have resulted in high sales of boats and luxury yachts, which is estimated to uplift shipments of maritime radar devices across the forecast period.

Increasing defence budgets, rising geopolitical tensions, technological advancements in the naval radar industry, expanding scope of military operations, and integration of naval radars with different maritime systems and technologies are also slated to offer attractive market growth scope going forward.

- In March 2023, China stated that its defence spending was expected to rise by 7.2 percent in 2023, which is the fastest pace recorded since 2019 as tensions with the United States escalate on various issues. The Ministry of Finance of China also reported that the military expenditure is estimated to reach US$ 225 billion by the end of 2023.

The United States is known to be a big spender in the military and defence sector, which is projected to primarily attract naval radar companies toward the country in the future.

- As per an article published on USASpending, the Department of Defense (DOD) of the United States had distributed US$ 1.98 trillion among 6 sub-components of the military and defence aspects for the financial year 2023.

Increasing spending on the upgradation of advanced naval systems on ships, the presence of key naval radar companies, rapid adoption of advanced radar technologies, expanding naval fleet, and rising demand for coastal surveillance are other prospects that could augment sales of maritime radar systems over the next ten years.

- In January 2022, Flight IIA Arleigh Burke-class destroyers of the United States Navy fleet were expected to start getting an upgrade to SPY-6 V (4) radars from Raytheon, as part of a US$ 237 billion contract awarded to the company in early December 2021.

Prime naval radar companies are focusing on launching new products to advance their business potential and gain a competitive advantage over other market players in the global landscape.

- In September 2020, Furuno Electric Co. Ltd., a leading name in the naval radar industry announced the launch of its new Magnetron-free Radar/Chart Radar solution in S-band and X-band configurations. The company also launched two new Solid-State X-band models at the same time.

- In April 2019, Wärtsilä, a leading name in marine and energy equipment manufacturing, announced the launch of its new RS24 K-band maritime radar that is capable of detecting small objects efficiently to improve port safety even in busy conditions. The product was expected to be highly important for congested shipping routes to avoid issues.

Collaborations, mergers, and acquisitions are also expected to be popular strategies among naval radar providers to hasten the development and launch of novel naval radar systems.